How To Claim Life Insurance . Formalities for a death claim. You can contact them by telephone, postal and, more frequently, using an online claim form.

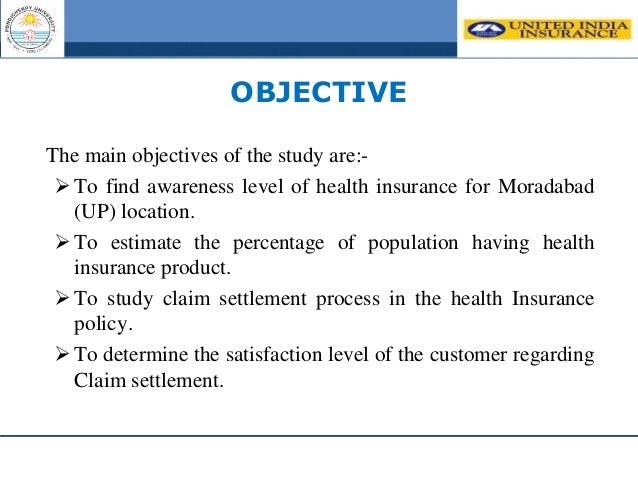

A STUDY ON AWARENESS OF HEALTH INSURANCE PRODUCTS AND from www.slideshare.net

As mentioned earlier, you’ll need just three documents to file your claim. Ideally, it will be stored safely, such as in a metal filing cabinet or fireproof lockbox. Formalities for a death claim.

A STUDY ON AWARENESS OF HEALTH INSURANCE PRODUCTS AND

First, alert the life insurance company to your intent to make a claim. To whom it may concern; Some companies ask beneficiaries to start by sending in a form that merely reports the death; Contact details will be on the insurer’s website and on the policy document.

Source: www.boatus.com

Check Details

Life auto home health business renter disability commercial auto long term care annuity. Contact details will be on the insurer’s website and on the policy document. How to file a life insurance claim. For this stage we should inform in advance the bank account number to the insurance company. To whom it may concern;

Source: affidavitforms.org

Check Details

Xyz life insurance company p.o. Here are the steps to take when making a life insurance claim. Let's discuss all three in detail. During this period, your insurer can carefully investigate your case and refuse a payout if there is any false information on your life insurance application.”. The details required for intimation are policy number, name of the insured,.

Source: partners4prosperity.com

Check Details

Term life insurance at your pace. The life insurance company will not normally have any knowledge of the passing of the insured. During this period, your insurer can carefully investigate your case and refuse a payout if there is any false information on your life insurance application.”. Life insurance claim letter sample. On your own or with a licensed agent.

Source: www.slideshare.net

Check Details

To whom it may concern; Intimation to the insurance company about the claim. You can contact them by telephone, postal and, more frequently, using an online claim form. The details required for intimation are policy number, name of the insured, date of death, cause of death, place of death, name of the nominee etc. With any luck, you’re already aware.

Source: mackoul.com

Check Details

Remember that it’s your responsibility to notify the life insurance company and provide the relevant paperwork. Box 9878 omaha, ne 68164 attn: Death certificate and all supporting documents. The nominee should inform the insurance company as soon as possible to enable the insurance company to start with the claim process. Steps for claiming life insurance after a death.

Source: www.ruralmutual.com

Check Details

They then send the beneficiary a packet of forms and instructions explaining how to proceed. The policy documents will specify when and how to submit claims. On your own or with a licensed agent. Remember that it’s your responsibility to notify the life insurance company and provide the relevant paperwork. Intimation to the insurance company about the claim.

Source: www.daveramsey.com

Check Details

First, alert the life insurance company to your intent to make a claim. The following is a checklist for life insurance claims. The final procedure of a life insurance claim is the payment of insurance claims to the heirs of the insured. Here are the four steps you’ll need to follow when you file a death claim. Formalities for a.